Anubhav Sahu

Monycontrol research

Highlights:

-Leading manufacturer for key crop protection and performance chemicals

-Benefits from trend for India as a favored destination for sourcing chemicals

-Strong additional revenue potential (~0.9x FY18 sales) based on capacity bandwidth

-Margins aided by operating leverage and backward integration

-Stock at reasonable valuation, given growth prospects

-------------------------------------------

Atul (Market cap: Rs 9,940 crore), one of the largest integrated chemical manufacturers in the country, is currently reaping the benefits of improved end markets and better spreads.

Ongoing supply-side reforms in China and India becoming more favored as a destination for sourcing chemicals will act as key catalysts for the company's growth.

While its foray into new products and its available capacity bandwidth have made Atul to meet the improving demand, efforts on backward integration and lower finance cost are expected to aid its bottom-line growth.

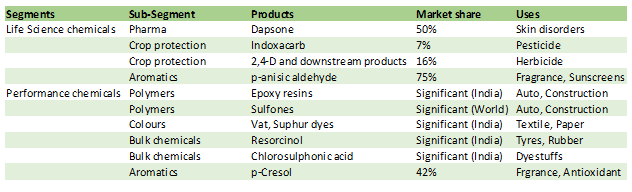

Table: Significant market share in varied chemicals

Source: Company

Market leader in key chemical products for crop protection and APIs

A bulk of the company's life science chemicals segment (which brought in 34 percent of its FY18 revenue) serves the crop protection end market (around 21 percent of the revenue), wherein key products 2,4-Dichlorophenol (2,4-D) and Indoxacarb command significant market share across the globe.

While 2,4-D is used as an intermediate chemical for herbicide, Indoxacarb is used as a pesticide.

In case of another life science chemicals sub segment -- pharmaceuticals -- the company is involved in production of various basic chemicals (amino acids, phosgene derivatives) and APIs.

The API for which the company has a market leadership is di-amino di-phenyl sulfone (Dapsone), which is used to treat skin disorders like Hansen's disease

Commands significant presence in the performance chemicals

In the performance and other chemicals segment (which accounted for 64 percent of the company's FY18 revenue), Atul manufacturers chemical intermediates for various end markets.

The company is a market leader in the manufacturing of various aromatic compounds (which account for around 17 percent of its revenue) like p-cresol, p-anisic aldehyde and p-anisic alcohol, which have applications in the personal care and fragrance end markets.

Sodium sulphate, which is a by-product of p-cresol production, is used in the paper and food preservatives industries.

Also, Atul is among the largest manufacturers of Vat and Sulphur black dyes in the colour sub segment (which accounts for 15 percent of its revenue). These have applications in the textile and paper industries.

It’s noteworthy that the company benefits from the imposition of anti-dumping duty on Sulphur black imported from China. It also has a JV with German company Rudolf, through which it offers a full range of textile dyes.

Atul's polymer sub segment (which accounts for 27 percent of its revenue) is one of its oldest businesses, having started as a JV with Ciba Giegy (Cibatul), and is a pioneer in the production of epoxy resins.

Here, the company’s brands Polygrip and Lapox are well known in end markets like furniture, auto and construction.

Q2 FY19 results: Benefits from better pricing trends

In recent times, Atul's operating performance has excelled in both segments. Standalone Q2 sales grew by 28 percent on year, aided by strong growth in life science (30 percent YoY) and performance chemicals (26 percent YoY).

The company's EBITDA improved 52 percent on year (margin: 18.9 percent) on account of better pricing and operating leverage.

Chart: EBIT margin trend

Source: Company

Initiatives for capacity enhancements – sales potential Rs 2,780 crore

Atul expects improved capacity utilization and de-bottlenecking initiatives can help it reach Rs 740 crore in revenue. Also, greenfield and brownfield projects are expected to earn Rs 1,400 crore revenue from existing products in the coming years.

In addition to this, projects for new products are seen having a sales potential of Rs 640 crore. Overall, the company’s capacity enhancement initiatives can help it garner additional revenue of Rs 2,780 crore in the coming years on a base of Rs 3,148 crore in FY18.

Backward integration to aid margins

Atul has a joint venture with Akzo Nobel (50:50) to produce monochloro acetic acid (MCA), which in turn is used in the production of 2,4-D. The JV's capacity is expected to reach 32,000 tonnes by Q4 FY19.

Strong balance sheet and cash flow visibility

The company repaid its debt last fiscal year, which means it now has more scope to fund capacity expansion in the future. Also, its return ratios and free cash flow are expected to improve on the back of economies of scale, improved pricing, better end markets and lower finance costs.

Risks: Oil and currency

Higher prices of crude oil remains a key risks for Atul. Over the last five years, the company's gross margins have fluctuated by around 10 percent because of volatility in oil prices.

Also, Atul earns around half of its revenue from exports, which makes it vulnerable to forex fluctuations. However, about 30 percent of the company’s requirement of raw material is sourced from outside India. To that extent, it enjoys a natural hedge.

While production cuts in China need to be watched. They have been beneficial for most, but a few of the crop protection chemical intermediates are sourced from China.

Outlook

Atul's medium-term topline growth (low double-digit growth in the next three years) is expected to be driven by positive growth outlook in diverse end markets (mainly automobile, crop protection, dyes, and fragrances) and an improved pricing effect for some of its products.

In order to take advantage of the improving demand outlook, the company is equipped with a relevant capacity bandwidth (more than Rs 840 crore capex over the last four years).

Additionally, the company's operating margins are expected to sustain at their current levels (17-18 percent) in the medium term due to a favorable supply-demand scenario in some of the segments and recent retracement in oil prices.

The stock is currently trading at 23 times the company's estimated earnings for FY20, which seems reasonable given its growth prospects.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!